Ethereum rally driven by structural demand surge, says Bitwise

The Block

2025-07-23 20:10:18

Ethereum is in the middle of a “demand shock,” with exchange‑traded funds and newly minted corporate treasuries buying roughly 2.83 million ETH worth an estimated $10 billion since May 15 — about 32 times more than the network minted over that span — and the gap is likely to widen, Bitwise Chief Investment Officer Matt Hougan wrote in a July 22 memo.

Hougan said ether has climbed more than 65% in the past month and over 160% since April, a move he attributes primarily to that imbalance rather than shifting sentiment.

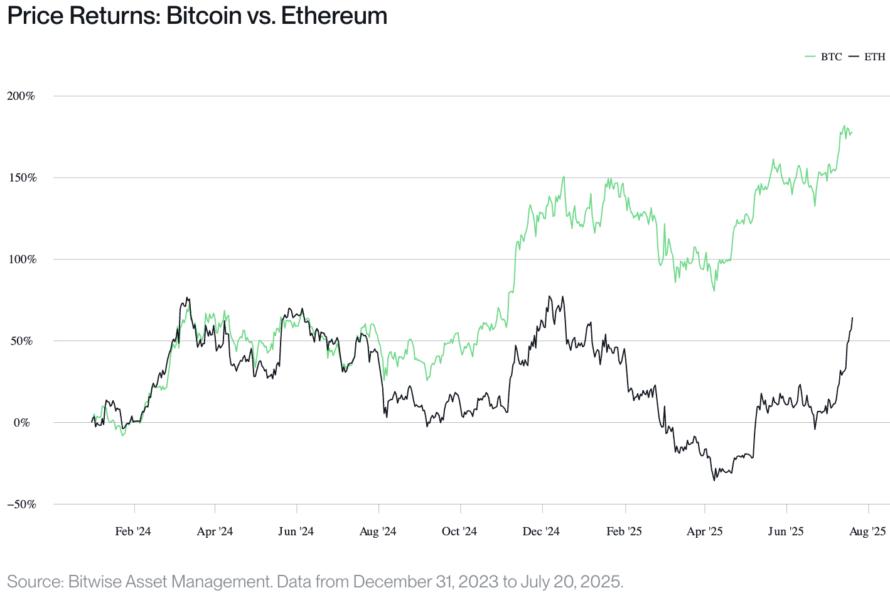

Bitwise’s CIO compared the setup to Bitcoin’s 2024 run. Since U.S. spot Bitcoin ETFs launched in January 2024, Wall Street funds, publicly listed companies like Strategy and Trump Media, and even governments have amassed more than 1.5 million BTC while just over 300,000 coins were mined — a five‑to‑one demand edge that Hougan said helped push prices up 155%, making bitcoin the best‑performing major asset in that period. “Five times more demand than supply. Sometimes it really is that simple,” he wrote.

Ethereum didn’t enjoy that tailwind at first, Hougan said. Some 10 months after launching in July 2024, ETH ETFs had bought only 660,000 coins with about $2.5 billion of inflows, while public company purchases were negligible, and issuance totaled 543,000 ETH. Unsurprisingly, Ether lagged behind Bitcoin over that time.

Bitcoin vs Ethereum price since February 2024. Image: Bitwise

Institutional appetite

Then the switch flipped. Since mid‑May, spot ETH products have gobbled up more than $5 billion in Ether, while corporates including BitMine Immersion, SharpLink Gaming, Bit Digital, and the soon‑to‑list The Ether Machine unveiled sizable treasury strategies. Altogether, those entities bought 2.83 million ETH and likely sparked the current rally to over $3,80.

Hougan argues the flow isn’t done. He projects that ETFs and ETH treasury companies could buy about $20 billion of ether over the next year — roughly 5.33 million coins — against the expected issuance of just 800,000 ETH, nearly a 7‑to‑1 ratio. He noted that investors are still underweight in Ethereum compared to Bitcoin, but expects a swift change as stablecoin and tokenization trends continue to garner attention.

“In the short term, the price of everything is set by supply and demand, and right now, there is more demand for ETH than supply,” Hougan wrote. “As a result, I think we’re heading higher.”

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

최신 뉴스

CoinNess

2025-08-02 23:00:10

CoinNess

2025-08-02 22:26:42

CoinNess

2025-08-02 21:04:54

CoinNess

2025-08-02 20:45:06

CoinNess

2025-08-02 18:58:49